On August 5, 2024, Bangladesh Prime Minister Sheikh Hasina was ousted following weeks of deadly student protests over the job quota system. The former Prime Minister has since fled the country and taken refuge in India. Meanwhile, Nobel Peace Prize laureate Muhammad Yunus has been tapped to lead the interim government.

A combination of factors, including higher unemployment, persistent inflation, and chronic corruption, triggered the Colombo 2.0 situation in Dhaka

The recent political unrest in Bangladesh stems from long-standing discontent over a quota system that reserved 56% of government jobs for specific groups, including 30% for descendants of freedom fighters from the 1971 War of Independence. The system is perceived to favour political elites (mainly from the former ruling Awami League party) and severely limit job opportunities for the country’s large youth population. In a nation of 170 million people, more than 18% of the population is facing unemployment. Initial signs of protests were seen in 2018 at Dhaka University and other campuses, with students being largely peaceful and demanding a reduction of quotas in government jobs.

Subsequently, the Hasina administration abolished the quota system in response to student mobilisation in 2018. However, in 2024, the Supreme Court rescinded the government decision and reinstated the quota system, reigniting the protests. Tensions escalated after an incendiary speech by Hasina, who referred to the protesting students as “rajakaar”, a term for pro-Pakistan collaborators (indirectly referring to them as terrorists). The peaceful student protests began in June this year and soon became a nationwide anti-government and pro-democracy movement. Violent crackdowns by the Hasan administration have reportedly caused the deaths of at least 300 people.

Meanwhile, broader issues under Hasina’s rule, such as persistent unemployment, soaring inflation, chronic corruption, and the erosion of democracy, also contributed to the widespread unrest. Many political opponents faced imprisonment under the Hasina administration and were disbanded from participating in elections. Moreover, despite strong economic growth under the Hasina administration, the post-pandemic recovery has been sluggish and beset with high inflation and depleted foreign currency reserves. The situation culminated in a nationwide uprising, with protesters demanding Hasina’s resignation.

Bangladesh’s economic situation may become tricky in 2024-25, with revenues staying low and forex reserves fading fast

Over the last decade, Bangladesh has reported an average of 6.5% GDP growth. However, the country continues to face economic headwinds post-pandemic due to persistent inflation and a widening balance of payments deficit. Notable, the headline inflation stood at 9.7% in June 2024. The balance of payment deficit contributed to the significant depreciation of the Bangladeshi Taka. The weakening of the taka further fuelled domestic inflation as the cost of imports rose. Higher inflation has also resulted in subdued private consumption and investment, which slowed GDP growth from 7.1% in FY2022 to 5.8% in FY2023.

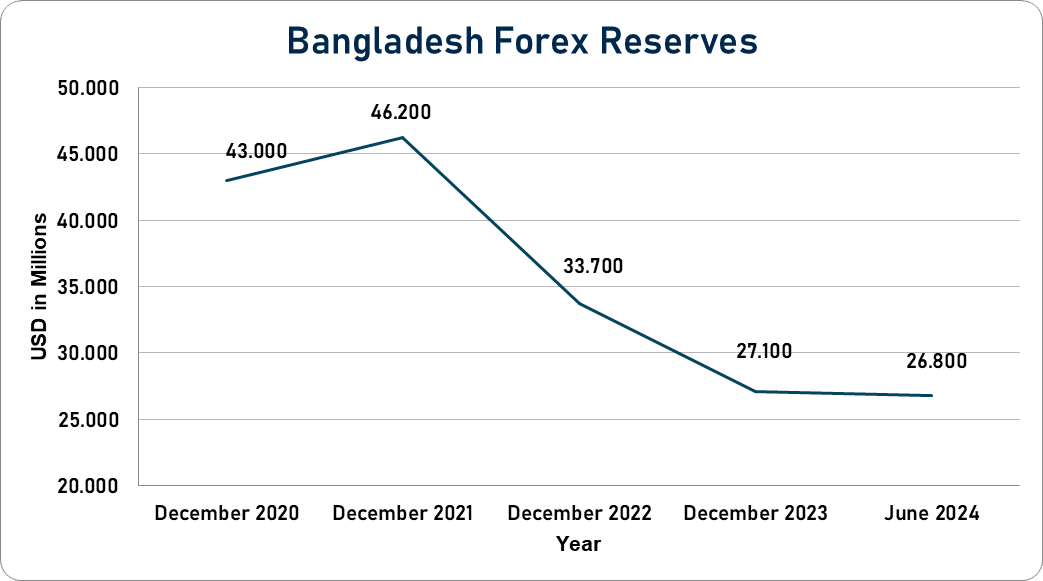

To control the rapid fall of Taka, in September 2022, the central bank introduced a multiple exchange rate mechanism, instructing the Bangladesh Association of Banks to set different export, import, and remittance rates. However, this mechanism failed to stabilise the forex market and instead intensified reserve erosion as the dollar selling rate from the reserve was the lowest of the rates. As a result, all commercial banks came to the central bank to buy the dollar from the reserve instead of purchasing from the market, depleting forex reserves faster. On the other hand, the expatriates opted for the secondary market to send their currency, facilitating the illegal transfer of money to other countries (via hawala). The forex reserves plummeted from a peak of USD48 billion in August 2021 to a little short of USD27 billion in June 2024. Subsequently, in January 2024, the central bank governor opted for a crawling peg exchange system, with the backing of the International Monetary Fund (IMF). The new system allowed banks to buy and sell US dollars at around Tk 117 freely.

Bangladesh’s forex reserves dropped by 37.6% since 2020

Meanwhile, the Government debt accounted for 23.6% of the country’s nominal GDP in December 2023, compared with the ratio of 20.6 % in the previous year. Notably, Bangladesh also sought a stabilisation package of USD4.7 billion from the IMF in January 2023. On July 30, 2024, S&P Global Ratings lowered its long-term foreign and local currency sovereign credit ratings on Bangladesh to ‘B+’ from ‘BB-’. While B is considered more vulnerable than BB, the agency views that Bangladesh still can meet its financial commitments.

Given the current economic conditions, we believe the GDP growth will likely decrease to 5.7% in 2024-25.

Challenges for the new government

- The most immediate challenge the new government faces will be to bring law and order under control and restore public trust in the government institutions. The demand to install Yunus, a Nobel Peace Prize awardee who is also an economist and civil society leader, as the new leader goes to show the public’s distrust towards mainstream politicians. The unanimous acceptance for Yunus signals that the current political crisis can likely be a boon to Bangladesh’s democracy, leading to fairer elections and increased participation of political opponents.

- Simultaneously, the other massive task is to stabilise the economy. This will include ramping up the country’s revenue base to replenish government reserves. Bangladesh’s revenue-to-GDP ratio has dropped from 9.6% in 2015 to 7.9% in 2023. The transformation will demand phasing out tax benefits to established sectors, curbing corruption in tax departments, and digitalisation to improve tax compliance.

- Further, the country would need to monitor monetary policy closely as the crawling peg exchange rate system carries the risk of creating artificial exchange rates, increasing the risk of speculators, forex traders, and market forces, which may derail currency stabilisation efforts. Overall, the next two years will be very important for Bangladesh to restore investor confidence in Bangladesh’s economy as the repayment schedule for many of the costly loans will begin in 2025.

- Businesswise, Bangladesh’s political instability has already caused operational disruption to the manufacturing sector, especially the textile sector—the country’s prime export contributor. The shutdowns and supply chain chaos have incurred losses of USD 300 million. Yesterday, the Bangladesh Garment Manufacturers and Exporters Association announced plans to reopen the factories on August 7, 2024. We expect business disruption to be temporary and likely to stabilise in the next two weeks.

We are closely monitoring the situation on the ground and will update as events develop.